Marketing fail: ‘Your company does that?’

Filed under: Business Growth, Profitable Growth, Uncategorized

Article posted in The Business Journals

by Andy Birol, Contributing Writer

Nov 12, 2013,

Your company does that?

Are there four words that frustrate you more as a business owner?

Even after all the marketing, selling, messaging and posturing, it’s not working when:

click here to read more.

Tying Your BHU to Running, Fixing, Growing and Preparing to Sell Your Firm

By Andy Birol, Birol Growth Consulting

For decades I’ve challenged owners and their firms to focus on their Best and Highest Use (BHU). When companies and their leaders do this, they demonstrate a deep understanding of what they:

* Are good at doing

* Like doing

* Know their market values them for doing

And when firms focus their Best and Highest Use on a specific target market by resolving a customer’s specific pain or helping them realize a new opportunity, they are stars as seen in the following graphic:

This approach is inarguable when we grow a business, but what about when growth is not the priority? If your business has slipped out of control, or is at risk of surviving, or the time’s come to prepare to sell, isn’t it just as important to focus on its BHU? And, that’s exactly when your company needs you to focus on your BHU. Here is why.

How Focusing on Your Best and Highest Use Focuses Your Business Activities

Running your business. Running your business. Whatever stage of maturity your business is in now, if its drifting, you will have to shift gears and recommit more of your time, attention or money into running sales, operations or finance, and into developing your management or culture. Perhaps you took your eye off the ball or took it too easy. But you must go back to the basics and you will.

Running your business. Running your business. Whatever stage of maturity your business is in now, if its drifting, you will have to shift gears and recommit more of your time, attention or money into running sales, operations or finance, and into developing your management or culture. Perhaps you took your eye off the ball or took it too easy. But you must go back to the basics and you will.

Did it take a defining point? Was it when you recognized problems with your customers that you recommitted to running your business? Did you decide that your pain of change became less than your pain of not changing? Most owners refocus their business around their Best and Highest Use. Owners will rediscover their business and run it the way it needs to be run.

Fixing your business. Despite your attention and focus, some portion of your business may eventually need to be fixed. Some of your customers will become unprofitable and you must return your business to financial health. You will need to cut costs, restructure your sales and marketing, or profoundly change where and how you produce and deliver your products or services. Despite years of success, re-fixing your business will require a level of effort you never imagined needing again since the first years but, here you are, doing it again to ensure your company’s future. Revive your firm’s and your own BHU, and it will be the foundation for fixing your business.

Fixing your business. Despite your attention and focus, some portion of your business may eventually need to be fixed. Some of your customers will become unprofitable and you must return your business to financial health. You will need to cut costs, restructure your sales and marketing, or profoundly change where and how you produce and deliver your products or services. Despite years of success, re-fixing your business will require a level of effort you never imagined needing again since the first years but, here you are, doing it again to ensure your company’s future. Revive your firm’s and your own BHU, and it will be the foundation for fixing your business.

Growing your business. If you don’t have focus on running or fixing your firm, then it’s time to go full steam ahead and invest in accelerating the profitable growth of your firm. Confirm your firm’s Best and Highest Use is aligned with what your customers want and need. Then, refocus your sales and marketing on finding, keeping, and growing more customers. Doing so, especially when the economy is expanding, will help you to build your wealth and the value of your firm. You will accumulate wealth for your future as well as protect your firm from inevitable down times. In good times, invest in marketing to create new demand for your firm’s BHU and into sales and customer service, to acquire and keep as many customers who value and pay for your firm’s BHU.

Growing your business. If you don’t have focus on running or fixing your firm, then it’s time to go full steam ahead and invest in accelerating the profitable growth of your firm. Confirm your firm’s Best and Highest Use is aligned with what your customers want and need. Then, refocus your sales and marketing on finding, keeping, and growing more customers. Doing so, especially when the economy is expanding, will help you to build your wealth and the value of your firm. You will accumulate wealth for your future as well as protect your firm from inevitable down times. In good times, invest in marketing to create new demand for your firm’s BHU and into sales and customer service, to acquire and keep as many customers who value and pay for your firm’s BHU.

Preparing to sell your business. Regardless of your intentions to sell, leave, or pass your business on, all businesses either grow or are sold to others who will further grow them. (When businesses fail, they are sold into bankruptcy.) But you will want to define your legacy beyond your firm’s financial success or for others to carry your vision forward. Define your legacy on your terms of your social entrepreneurism, family culture or meritocracy and how you wish to show it. Selling your business is the final expression of your BHU. This is up to you when it’s time for you to move on but only after you have successfully run, fixed, and grown your business. And then you must take your BHU of running your business and apply it to what is next for you.

Preparing to sell your business. Regardless of your intentions to sell, leave, or pass your business on, all businesses either grow or are sold to others who will further grow them. (When businesses fail, they are sold into bankruptcy.) But you will want to define your legacy beyond your firm’s financial success or for others to carry your vision forward. Define your legacy on your terms of your social entrepreneurism, family culture or meritocracy and how you wish to show it. Selling your business is the final expression of your BHU. This is up to you when it’s time for you to move on but only after you have successfully run, fixed, and grown your business. And then you must take your BHU of running your business and apply it to what is next for you.

Recognize the Cycle of Running, Fixing, Growing and Selling Your Business. Whatever kind of firm you own, you will have multiple opportunities throughout your (and its) lifetime to focus your attention on running, fixing, growing or preparing to sell it.

Recognize the Cycle of Running, Fixing, Growing and Selling Your Business. Whatever kind of firm you own, you will have multiple opportunities throughout your (and its) lifetime to focus your attention on running, fixing, growing or preparing to sell it.

Sometimes after spending years growing your firm, you may discover that some part of it still isn’t working. So you must place your attention back onto fixing your business. Or, as many business owners learned between 2006 and 2011, their firms were not ready to be sold, but instead needed to be re-run, re-fixed and re-grown to build back the value the economic downturn denied of them and their retirement.

Which Phase Needs Your Focus?

There’s an old saying. “Once is a coincidence, twice is a trend and three times is a certainty.” Take a look at your business today. Do you feel it needs your focus in one of the four areas we’ve discussed?

Don’t ask, “Why should I have to fix my company again?” Instead, recognize that your business, just like your family, is one giant circle. As adults, we were all once children. And, after parenting our children, sometimes we have to be parents again to our parents. Similarly, our businesses may need us to go back to the basics or even worse, repair the broken part again, long after we thought it was fixed once and for all. And we must do this even if our heads and hearts were more focused on creating our legacies and preparing to pass on our businesses to the next generation.

To summarize — regardless of running, fixing, growing or preparing to sell —always focus yourself and your company on your and its BHU, and you can’t go wrong!

Andy Birol helps business owners create profitable growth by growing their Best and Highest Use. To learn more about how your business can benefit from applying these ideas, take the Growth Potential Indicator Assessment at www.growthpotentialindicator.com. Or contact Andy directly at (412) 973 2080 or abirol@andybirol.com

Bridging Your Business Strategy to Your Web Strategy: Three Steps to Tie These Together.

Filed under: Business Growth, Marketing and Technology, Profitable Growth

by Andy Birol, Birol Growth Consulting and Robert Faletti, Blue Archer

You meet a business owner or someone on his or her staff who passionately tells you what the company does. Intrigued, you later go to their website only to experience a severe disconnect between the website’s messaging and the business owner’s description of the business Conversely, you’re on a company’s website, trying to learn all you can before you meet with them. Unfortunately, as you probably show you’ve done your homework, they interrupt you only to say, “our website needs to be updated as that’s not what we do anymore.”

After 20 years of firms building their Internet strategies, there is still a significant gap between most company’s business and web strategies. Perhaps this is not surprising as there are over 20 centuries of firms on their business strategy. So not only do we have 100 times more experience working on our businesses before the Internet appeared, but many of us will admit that our strategy for running our business probably needs at least a tune-up if not some major rethinking. And while all serious businesses have had a web presence for at least a decade, few if any companies are really happy with their web presence. So it’s no surprise that most firm’s business strategy is not really connected to their web strategy.

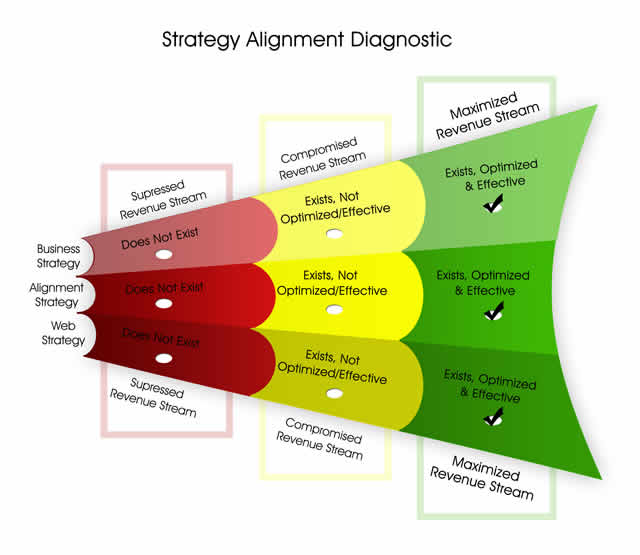

The disconnect, or misalignment, between a business strategy and a marketing strategy often represents a significant opportunity cost for the business. This opportunity cost may manifest itself in many ways, however a compromised or suppressed revenue stream is usually the result. While most can agree that an effective business strategy is critical to success, a web strategy, and its alignment with the business strategy is often overlooked. The following graphic shows the impact of divergent strategies, and how they can suppress, compromise or maximize company revenue streams.

To resolve this conundrum, here are three steps:

1. Ask yourself, separately and independently:

a. What is my business strategy?

b. What is my web strategy?

c. If you can define both strategies, then move onto step two.

2. Against clear measurements, determine if:

a. My business strategy is effective

b. My web strategy is effective

c. If you believe both strategies are effective, then move on to step three

3. Are my business strategy and web strategy connected, interdependent and symbiotic?

If you find that your strategies do not exist, are not effective independently, or are not aligned, you are not realizing an optimal revenue stream, or worse.

Think of your challenge in terms of building a bridge. For centuries, bridges have been built by first creating strong foundations on both sides. Once these are sturdy work crews build their way out and towards the center of the void. If constructed with excellent communication, the two halves of the bridge are joined in unison. Not only has a passable, seamless pathway been constructed but, hopefully, it will stand the test of time.

Imagine if your business strategy and web strategy worked as well together as you need it to. Well, consider the effort that goes into building a bridge temperature vision and put your construction skills to work. You will be delighted with the fruits of your labor!

What if the Far East Ran Marcellus?

Filed under: Marcellus, Marcellus Shale, Profitable Growth, Uncategorized

What’s more frustrating? Trying to devise new products you can introduce to the shale industry or counting all the obstacles you face to grow your business? Do you ever wonder how another culture or society might tackle your opportunity and challenge in the Marcellus Shale? Two recent experiences have me thinking about this. First, I just returned from a month’s travel through the world’s business shipping channel, the South China Sea, visiting 6 countries and witnessing how China, Vietnam, Cambodia, Thailand, Singapore and Hong Kong are succeeding despite wrestling with big problems. Second, I just saw the anti-Marcellus movie, “Promised Land” which, while entertaining, paints the shale gas industry and its opportunity as absolutely evil and the good people of Pennsylvania as painfully naïve.

So I was just thinking…what would happen if the Far East had the potential windfall of a shale gas opportunity and how would they exploit it? First, here are some of my observations on my first trip to the region.

- No matter which country I visited, everyone asked me the same question, “Is America going to avoid going over the fiscal cliff?” When I asked them why they are so worried, they say all they need America to do is to thrive as this benefits the whole world. When I asked, “What else do you want?” They said, “Nothing” they said, since they believe they are otherwise self-sufficient and accountable.

- As tensions ebb and flow between the Chinese and their neighbors in this historically volatile region, every country is focused on working hard and is hopeful that the New Year will bring good luck. Nothing more. Nothing less.

- The region’s economic winners, Thailand, Singapore, Hong Kong and China, succeed within tightly structured systems and under autocratic leadership, and yet their people yearn for the freedoms of choice, entrepreneurship, religion and lifestyle we take for granted here in the US. They don’t believe they have what they want so they make the best with what they are allowed.

- Whether it is truth or urban legend that the Chinese word “crisis” is a combination of the words, “danger” and “opportunity,” the incredible futuristic cities of Singapore, Bangkok and Hong Kong makes one’s head spin in wonder of how did they do it?

- Singapore’s corporate leadership in sustainability with economic growth based on energy and commodities.

- Hong Kong’s capitalistic perseverance is incredible in the face of China’s increasingly autocratic heavy hand.

- Bankok’s melding of modern ways with a benevolent monarchy and traditional Buddhism creates a most attractive culture and country.

So what lessons can Pennsylvania manufacturers learn from one of the world’s most competitive and challenging regions on how to seize our shale gas day? Here are some thoughts:

- Find opportunity in crisis. Transfer manufacturing know-how from serving coal and oil producers to serving gas companies. Some of these companies, like Consol is, itself shifting its operations from coal to gas.

- Make the best of what is happening within your culture. Exploit the local consumption of gas. With low gas prices, local PA manufacturers can benefit from using gas in their operations and by anticipating the needs of energy companies to convert their coal-fired plants to gas.

- Compete. As plastic-producing plants come on-stream, how can local job shops serve them and their down and upstream supply chain?

- Use our freedom and creativity to explore and improvise. Which manufacturing opportunities can be uncovered from the shale gas millions being spent in the transportation, infrastructure and construction sectors as they benefit from the building of pipelines?

Sometimes the positive examples of far-away regions are just as motivating and mind clearing, as they are practical and applicable. And sometimes the locally painful stereotypes exploited by Hollywood can be sufficiently antagonizing as to cause positive breakthroughs.

All I know is we have a great big opportunity that the rest of the world envies and is watching how we exploit it. I look forward to helping to identify the best in the Marcellus for every manufacturer in the region!

WWWWW: Why Won’t Wonderful Websites Work?

Filed under: Business Growth, Pittsburgh, Profitable Growth, Uncategorized

For the fourth time in 15 years I’m revamping my website. My technology wingman groans, rolling his eyes and thinks, “Here he goes again.”

Why does the website that made me so proud a few years ago make me cringe? The reasons jump out at me:

It’s too complicated. The messaging isn’t clear, the back end doesn’t work, it’s not SEO-friendly, visitors are down and it’s not written in the right language. Length of stays is down, it’s not customizable, and, thanks to statistics on Google Analytics, the website just isn’t doing the job.

It’s too complicated. The messaging isn’t clear, the back end doesn’t work, it’s not SEO-friendly, visitors are down and it’s not written in the right language. Length of stays is down, it’s not customizable, and, thanks to statistics on Google Analytics, the website just isn’t doing the job.

I ask experts and gurus, “What’s your latest thinking on effective websites? What’s working?” The avalanche of ideas and advice I hear only makes things worse.

“Get your reader engaged”…”Crowdsource”…”Give away your value.”…”Tweet, tweet tweet!…”Improve your Klout score!”…Like everything you can on Facebook and you will be liked back”…Your Face book must talk to your blog which talks to your LinkedIn”… “Put ads on your site”… ”Reciprocally link”…”Update your meta tags”…. “Fool Google…”First page or fail!”…“Get people to talk about you!”

With a sense of déjà vu, I freeze up. I can’t move ahead or accept my website for what it is and isn’t. If I upgrade my website, I know I face thousands of dollars and worse yet, a hundred hours invested only to be no further ahead than where I am today.

I ask clients, referral sources, friends and family, “What do you think of my site?” I hear platitudes like: “It’s so informative.” “There’s so much great content.” You’ve done so much.” The worst is, “I was going to hire you anyway.”

I know I have to change my site or accept that websites are nothing more than billboards and content giveaways for a professional-services firm.

Then it hits me. All I ever wanted from my site was to provoke and qualify prospects into having a live conversation with me.

My business, like most conceptual services, only works when I have a conversation with a prospect who shares his or her goals and challenges with me. Website hits, visits, click-throughs, registrations, follows, likes or joins don’t really matter unless they create that conversation.

I went back to the roots about how my prospects hire me, how they build trust with me and their typical buying behavior in hiring me. For every 10 conversations, I can generate five meetings, three proposals and close one sale. And I have decided to build my new website simply to do this.

I can already hear experts scoffing, designers and social media mavens who preach the building of customer engagements, social friendliness and website stickiness. Frankly, I just don’t care. If my strategy generates 10 conversations a month but everyone else thinks it’s a bust, I’ll be pleased.

My business goal is to keep failing in new and different ways, and frankly I haven’t tried this before. And how much worse could it do? But maybe this time, I’ll be saying, “WWWW: Why Website’s Work Wonderfully!”

Should You Stay or Should You Go?

Congratulations, your business has survived the recession! Thanks to your leadership, you held off the banks, reduced your debt, collected your receivables and delivered great products and service.

Today, your firm runs lean, with loyal customers and reasonable profits. So what should you do next? Are you satisfied, dissatisfied or neither? Should you grow your business or should you sell it?

Today, your firm runs lean, with loyal customers and reasonable profits. So what should you do next? Are you satisfied, dissatisfied or neither? Should you grow your business or should you sell it?

Asking your advisors doesn’t make your choice any clearer. They declare your business is worth less now than before the recession, but not as much as it could be in five years. But to recharge your business you’ll have to refocus your efforts and reinvest some of your wealth back into your firm. Can you? Should you? How do you decide whether to grow or sell your business?

After working with hundreds and speaking with thousands of business owners, I am convinced the decision to grow or exit your firm means reconciling and aligning your personal and business goals. Here’s how:

- Decide on Your Personal Goals

- Needs: What type of income, validation and purpose do you need?

- Lifestyle: Do you live to work or work to live?

- Legacy: Has your business accomplished what you personally set out to do?

- Pinpoint Your Business Goals

- Life cycle: Is your business at its peak or trough?

- Best and Highest Use: Has your business fully exploited or squandered its value.

- Potential: Can you or someone else take your business to the next level?

After you’ve developed an objective list, you may not be any closer to the root issue. Just like a defining point drove you to start, buy or revive your business, you may need a defining point to help you decide if you will grow or sell your business.

Clarifying your defining point

Remember Popeye the Sailor Man (and original Zen master) standing up to Bluto, spluttering, “That’s all I can takes, ‘cause I can’t takes no more”? That’s what a defining point feels like.

As a business owner, you’re probably highly self-motivated, but do you know what got you started or keeps you going? Was it a flash realization or a series of events? What led to your decision to grow your own business, overcome obstacles, and ultimately succeed? Answer these questions to narrow down your defining point:

- When did it occur?

- How did you know what it was?

- Since it occurred, what do you now know and do?

- Since it occurred, what do you no longer believe or do?

- How does your defining point give you confidence?

Identifying this source of conviction is the first step toward growing your business, because it will power your commitment to implement the knowledge, behaviors, and tools of successful owners. Clarifying your defining point will also help to reconcile your business, family, health, and other life challenges in a way that works for you. How can it accomplish so much?

Passion can be mistaken for blind faith, and blind faith has killed many businesses. (Okay, it’s built some really good ones, too, but let’s go with the odds.) The point is this: You need to know your limits. Astute owners balance knowing they can implement, sell, and deliver new ideas with the pragmatic necessity to make money. Avoid any new venture before taking a hard look at what you can sacrifice in terms of cash, time, people, and other resources. Otherwise, your conviction is really just wishful thinking.

Looks like you’ve made it

For years, I’ve seen venture capitalists and other financial gamers flail about in the ocean of ownership. I’m convinced that few of these financial intermediaries make great owners. They generally lack passion about what they sell. They talk about things like roll ups, cash outs, and other financial gimmicks, but don’t focus on delighting their customers, living their products and services, and standing behind everything they sell. Likewise, corporate players who try to cut and paste corporate tactics into a new business don’t experience the freedom or the success involved with building a company brick-by-brick on the strength of an owner’s distinctiveness.

Whatever their background, winners discard the trappings, the ego, and the support mechanisms and get, what owning a business is all about—delivering customer value.

Are these guys lucky? Do they possess a Midas touch that turns decisions into profits? Absolutely not. Their magic is the self-confidence that stems from believing in their companies. Their triumphs are the living, breathing examples of their core conviction that as business owners, they each control their own destiny through the passion and conviction they either do or don’t possess.

You can’t file conviction in a drawer and move on to the next challenge because, as your firm grows, the issues, concerns, and crucial decisions you face will evolve. The conviction of a rookie entrepreneur looks nothing like the conviction of an owner of a multi-million dollar company. Yet, however big a firm becomes, it never outgrows its foundation. An owner’s commitment, confidence, and conviction remain the crucial drivers of a company’s success.

Self-check: Ambivalence

Ambivalence is to the business owner what salty food is to an obese smoker with undiagnosed high blood pressure—a silent killer. Check the following symptoms to find out whether you are ambivalent. Do you agree with any of the following statements?

- My products or services aren’t all that effective.

- My customers don’t really deserve the best.

- My employees are replaceable.

- Sure, I can cut corners. Who’ll notice?

- What, me lead? My people know what to do. Leadership doesn’t really matter.

A “yes” answer to one or more of these statements indicates some level of ambivalence.

Whether our businesses are in transition, succession, growing organically or through acquisition, we owners all share a common standing. Once we’re recognized as business owners, we never want to go back to work for someone else. In our independence, we all belong to the one club that even Groucho Marx would want to stay in.

The freedom, affirmation and respect we encounter is difficult to replicate in the corporate world. And even if it does, it usually comes with strings attached. So it’s not surprising that the drive to protect what we’ve created could be the professional equivalent of a mother’s devotion to her child’s well being.

On the one hand, we fear the downside of failure, on the other, we yearn for all the opportunities we could be missing. How can we protect what we’ve earned, invest in new opportunities and avoid the clear threats our businesses face? These dilemmas torment many owners. How many times have you seen examples like these?

- A successful security alarm company ignores the clear trend toward smart homes and integrated home-theatre systems only to discover that these providers are now competitors as they include security alarms as part of their command and control systems.

- A maturing accountancy, searching for new services with better margins, starts offering executive search and outplacement. Instead of embracing these added services, their clients grow confused and wary, when even the partners struggle to explain why and how these different offerings work together.

- A computer cabling company moves seamlessly from connecting servers to setting up wireless connectivity. Their customers are grateful and even more loyal to their cabling company for shepherding them from obsolescence to state of the art.

In the final analysis, your role as a successful business owner may come down to two conceptual duties: demanding more predictability of your existing business and honing your skill in scouting out your environment.

You know you demand greater predictability from your existing business when you:

- Aren’t happy with great results until you know how they happened

- Become intolerant of erratic swings in sales or profitability and refuse to blame only the economy, competition, suppliers or customers for bad results

- Demand that successful activities in your firm be repeated, rewarded and routinized, and surprises become anticipated and eliminated.

You know you are becoming an expert scout of your environment when you can:

- Anticipate what your customers, employees and vendors will demand and already have a solution that meets their needs and yours.

- Interpret the difference between what your target market says it wants and have the confidence to offer them what they need.

- Look ahead at least three months and anticipate what your business will need in terms of sales, cash, expertise, and time to meet your goals.

For most business owners, growing a business is the fulfillment of their life’s work and dreams. When your business is growing, you feel in control of your destiny. The decision to sell or further grow your business comes down to where you stand on keeping your business growing in the right direction.

If you are still full of conviction to make it more predictable and to continue to scout out your environment you should stay in your business and grow it. If not, you should sell it.

If you need further help, contact me at 412 973 2080 and I have a questionnaire I can step you through to create the confidence and conviction you need to decide if you should sty or you should go!

©Birol Growth Consulting 2012 all rights reserved.

With All the Business in Technology, Where’s the Technology in Business?

Filed under: Business Growth, Profitable Growth, Uncategorized

Business people are fascinated by the benefits, profits and potential of technology. Just visit any tech event and witness the financiers, service providers and the media networking with techies to discover “the next business thing.”

Business people are fascinated by the benefits, profits and potential of technology. Just visit any tech event and witness the financiers, service providers and the media networking with techies to discover “the next business thing.”

But despite all this “technology-transfer”, why isn’t there more technology in business? After 15 years of consulting with more than 430 firms and presenting to or interviewing another 10,000 business leaders, I’m dismayed by how little technology actually makes it into most mainstream, medium and small businesses:

- Most inventories are still managed without RFID or other systems tied into the POS. Despite this decade-old technology being “so easy,” I still see many companies doing it by hand.

- Few companies have good CRM systems. While this software works, few customers integrate their systems with their own sales culture and process or ensure sales force commitment, crippling many users from benefitting from such new technology.

- True cost-accounting information is scarce. Ask business owners what their product or service really costs to make, sell and service and few honestly know. If they had more knowledge, they could more confidently limits test new offers and features.

- Knowledge businesses still communicate with tools from the 1900′s. Despite the many better ways to present and engage their audiences, the gap between what companies say they sell and what customers hear and buy remains enormous. Too few businesses are developing mobile apps or distance learning.

Here’s why there isn’t more technology in business:

- The culture of technology clashes with mainstream business. The technology culture values perfection of their means while mainstream business struggles to convert these means into profitable ends.

- Tech people are schooled to woo investors and grants not to sell to customers. Inventors and startups believe they must write plans to get financing before they approaching and selling customers. Customers need to be understood and served but investors want to be bought out and move on. Who is more important to business longevity?

- Associations and business-plan contests reward planning skills not results. Our schools, associations and governments reward techies more for their thinking than for their sales and profits.

- Social media often encourages engagement without closure. Blogging and tweeting without closing business is like having a fiancé for five years without a marriage.

Why should you in the technology community react or even care? Because mainstream businesses need you, your value and they have money to pay you.

Consider these 3 ways to help you put more of your technology in business:

- Make your “thing” work manually before you try to make it work with technology.

- Understand how your customers use your thing to make money, and whether it’s by selling more, spending less, saving time, reducing risk or improving their lifestyles.

- Sell some version of your product or expertise from the start while you seek investors.

Technology companies have big shoes to fill in sustaining the Western Pennsylvania economy beyond steel. Doing so takes driving their products and services deeply into mainstream business.

Through this column, I will provide you with ways and ideas to do so. Together, we can put more of your technology into business.

5 Steps to Refocus During Tough Times

Filed under: Business Growth, Pittsburgh, Profitable Growth, Uncategorized

Whether it’s the economy, your family, business, community or society, probably some part of your world has suffered over the last five years. Unfortunately, there are enough signs show that the next few years will continue to challenge even the luckiest, blessed and oblivious among us. Even as we strive do “right and good,” what do we do if: demand for what we sell, access to resources we require, or our energy and drive simply dwindles?

If you need a pep talk, read on.

If you need a pep talk, read on.

- Recognize bad signs fast. As it’s been said, once is a coincidence, twice a trend, three times, a certainty. If something isn’t working, figure out why ASAP. The world is changing faster yet most people can’t change at all. Every day I speak to people who feel trapped in so many ways. They have become what they tolerate because their pain of changing remains greater than their pain of not changing. In business, however, your marketplace (customers, employees and vendors and investors) will tell you the truth. For the other parts, get the personal, professional or spiritual support you need to accelerate changing your bad to good.

- Take stock in your value; Your Best and Highest Use® Accept quickly that your expertise and your firm’s experience are your greatest treasure. They remain yours forever and always the ingredients and foundation of your renewal.

- Keep your eyes open; seek opportunity. Wherever there is pain, need or hope, you can find and make opportunity. Follow your heart and your head. Your internal voices are ever more righteous as you mature. When most people take a hit, they lose faith in their judgment, impact and options. Stand apart and stay confident.

- Refocus, regroup, repurpose. Take your BHU and the opportunity or pain you uncovered and link these and then find customers who will value your repackaging. Activity matters so keep trying new versions and push forward. Try giving away your reinvention or better yet sell it right away. In facing setbacks such as bad timing, backward thinking and an ADHD society, rely on your passion and conviction to drive you to success. Remember your BHU is portable and deliverable. If you doubt where’s the demand for your value, go where you:

- Are getting human and viral response

- Have raving fans

- Are scarce

- Stay focused/don’t blink. Anything you create takes 3-6 months to generate reaction/awareness in the marketplace and 1-3 years to take root. Create the opportunities for quick wins and the metrics to prove your wins are real. Before you can generate market success and profitable growth, remember to create prospects, and qualify and develop them into buyers.

- Connect online as much as you can

- Get seen, heard and interviewed

- Identify and nurture allies, referral sources and champions

- Make your viral marketing portable; avoid investing in fixed costs, particularly of traditional sales and marketing.

Whether or not this all makes sense to you, think about the parts that do and put them to good use in refocusing your business in tough times. Email me at abirol@andybirol.com.

Making Money on Marcellus: First Lessons Learned

Filed under: Business Growth, Marcellus, Pittsburgh, Profitable Growth, Uncategorized

If you own a business in Western PA/Eastern Ohio, the more you learn about the trillion-dollar business opportunity called Marcellus Shale, the more you may wonder how you can best profit from it. But unless you’re selling directly to gas drillers or energy giants, you are probably wondering what to offer, who to approach and how to go to market. As I’m helping my clients and workshop attendees do this, here’s the first in a series of lessons I’ve learned:

If you own a business in Western PA/Eastern Ohio, the more you learn about the trillion-dollar business opportunity called Marcellus Shale, the more you may wonder how you can best profit from it. But unless you’re selling directly to gas drillers or energy giants, you are probably wondering what to offer, who to approach and how to go to market. As I’m helping my clients and workshop attendees do this, here’s the first in a series of lessons I’ve learned:

First Lessons Learned on Making Money on Marcellus:

- Make Marcellus your rising tide; not your tsunami: Find a portion of the overwhelming demand you can profitably supply and make sure you can deliver on any business you close. As tempting as it is, don’t let any one customer become more than 20% of your business. My friend Shaun Seydor’s seminal report ” The Economic Impact of the Value Chain of a Marcellus Shale Well” *is a must-read and linked here with his permission and my gratitude. Read it and think about where your can catch the wave.

- Follow the money and bring your “A” game: My early advice to clients is to avoid the big players (Range Resources, EQT, Chesapeake, Exxon/Mobil etc.) and sell to the companies who sell to these big boys. Stay one step removed from the “tier one” companies, and you can keep more control over how you do business. But it’s still a fast and furious world and strong contracts are imperative. Put your best foot forward and never forget: with all this opportunity you are competing in the big leagues. Fortunes will be made and lost. This is a great time to Recharge Your Best and Highest Use®

- Stake out your value and place in the food chain. Learning where and to whom you offer the greatest sustainable value is critical. There are many ways to slice the Marcellus marketplace. Identify your ideal target buyer and know their buying process. Build a selling process that matches their buying process. Here’s an article to help you think about this http://profitablegrowth.com/shout-out-or-shout-at-your-sales-force-is-it-generating-sales-growth-in-the-new-economy/ Also, decide where your business fits into these two graphs from the Marcellus report: Figure 1 – Types of Economic Impacts (p 4.) and Figure 2 – Phases and Key Steps in Developing a Marcellus Shale Well Site (p.10).

- Timing is everything. Many business owners I’ve met operating in the Marcellus tract complain that the “out of towners” won’t hire local companies or that “the money is yet to show up.” Make sure what you sell is ready to be purchased. Watching what your customer’s customers are buying is one way not to make your move too soon or too late. Here’s a piece I wrote in a different context but has some good tips on figuring out your best timing http://profitablegrowth.com/is-your-demand-down-or-distribution-dying/

- Chase transactions or relationships Most companies working in the Marcellus space can be split into transactional firms who do business one sale at a time (e.g. gas stations) and those relationship companies growing over the long term (e.g. cleaning companies.) Match how your business profits best to the right kind of kind of customers that you should do business with. To help you decide which you should focus on, here’s an article for you http://www.andybirol.com/DisplayContent.aspx?MenuID=626

Unlike the great Oklahoma Land Rush where everyone got a fair start at the same huge opportunity, Marcellus is much more complicated and tricky despite the trillion-dollar economic windfall it is. Stay tuned. This is the first in a series of pieces I will write as I learn lessons with my clients and workshop attendees on making money on Marcellus.

Do you have questions on how your business or audience can make money on Marcellus? Call or email me and let’s talk about it.

*By Heffley, Seydor, et al & the Katz Graduate School of Business at the University of Pittsburgh.

Finding the Extraordinary in the Ordinary For W.K. Thomas

Filed under: Business Growth, Pittsburgh, Profitable Growth, Uncategorized

As a growth consultant for small businesses, I’ve enjoyed many opportunities to see how various small businesses function, especially those that have operated for a number of years. In an age of understaffed companies and conflicting and competing demands, most of these companies are so busy helping their customers that they don’t take the time to help themselves.

They tend to lose sight of what I call the extraordinary that lies at the heart of the ordinary in their operations–the characteristics that make them special and unique. One such company in Butler County is W.K. Thomas.

The president of this company lacked a formal marketing program and realized that traditional, relationship selling would not get him to where he wanted to be—in the scarce space of marketing and sales in their respective businesses. Now, he’s changing his company to achieve that.

Thus far in our work together, he’s focused on expanding his values and defining and honing what I call his individual Best and Highest Use®. Best is what he loves to do. Highest is what he does really well. And Use relates to what his customers value and are willing to pay for.

Under the leadership of Brent Thomas, W. K. Thomas & Associates provides pre-engineered steel building and construction services to the commercial, industrial, community, and religious markets throughout Western Pennsylvania. Brent’s father, Bill, now Vice President, established W.K. Thomas in 1974 as a custom-home builder and general contractor. Since then, the company has remained a privately owned, family company.

Other firms rely heavily on the service offerings of project management and estimating as commodities to drive business forward. They end up competing in a market where bottom dollar pricing and the resulting low-quality construction become the norm. But Brent Thomas is linking the brand of W.K. Thomas to pre-engineered steel buildings as the company’s big differentiator and is driving revenues up. His company is growing a reputation in Butler County as the go-to company for these types of buildings.

“I’ve stepped outside of being jack of all trades,” says Thomas, “I’m focusing on pre-engineered steel buildings, which is our Best and Highest Use, have taken on more responsibility for sales, and I’m reorganizing our team to help energize this new direction.”

When I began working with Brent Thomas, he had a strong, well-established business with great potential for growth and wanted to take his company to the next level. What made sense for him was my ability to find the extraordinary within the ordinary of his company. My approach has been to find the characteristics that make him special and different from his competitors, and to cultivate these aspects into exciting opportunities to grow his business.

Working with him and his customers has led me to understand his product lines, how they add value, and how they develop special relationships with his customers, whose feedback is critical to our endeavor.

The upshot is that now W.K. Thomas is becoming more aggressive in proclaiming its value and more consistently educating its customers about what it can do to help them. Thus far, we’ve focused on expanding Brent’s values and defining and honing his individual Best and Highest Use®.

Throughout my years of consulting with businesses like W.K. Thomas, I’ve deployed this approach to help more than 430 businesses owners identify the specific markets that’s right for them and their companies. This has had a $450-million impact on the economy.

Best and Highest Use also immunizes companies against the “Be All Things to All People” disease. This disease is as common as a cold, but it’s as deadly as the plague for small businesses.

When business owners fail to target specific markets in this way, a number of consequences occur, all of which are bad. Their companies aren’t special. They’re mediocre, forgettable, or worse. People can’t refer customers to them. Their companies attract unqualified prospects and waste resources on prospects who could care less about their offers. This, in turn, diminishes their efforts with regard to prospects who do.

What’s more, best use helps business owners to resolve the greatest pain or create the greatest opportunity for a narrow slice of a market. This creates a crucial intersection for them between their companies, their Best and Highest Use, and the needs of their customers.

Over time, I’ve had the privilege of learning, using, and teaching a variety of growth tools for organizations. We’ve used a variety of names for these processes, including strategic planning, management by objectives, sales management, and incentive compensation. Too often, these systems steamroller over the interests of the users. The fact is that old-fashioned, autocratic tools just don’t work anymore.

More than a few times, I’ve had people challenge my concept of Best and Highest Use, saying that it’s just another term for distinctive competence, one of the buzz words that periodically make the rounds of corporations and MBA programs. In one way, they’re right. Best and Highest Use is essentially distinctive competence for business owners. The difference – and it’s a large one –is that although distinctive competence speaks clinically of skill sets and marketplace advantages, Best and Highest Use involves an owner’s emotions, goals, and personality.

One concept I hear kicked around is the term, best practices. But this assumes that all firms start out and grow and stay completely equal. To center your business on best practices is to deny, ignore, and disrespect your Best and Highest Use. How can you ever tell if you are better or worse than you should be if you only judge yourself on the basis of the lowest, common denominator of other companies?

Working together, Brent Thomas and I continue to focus on his individual Best and Highest Use to translate new customer demand into substantial, dramatic growth and confidence in his abilities.

In the short and medium term, we’re tailoring initiatives designed to achieve profitable sales growth. At the same time, this company leader is experiencing a renewed excitement and passion for his business. At a time of economic hardships when competitors are pulling back or taking cover, their passion and excitement is giving him confidence to make it work.

As we reinforce the abilities of W.K. Thomas to deliver higher value at lower cost, we’re decommoditizing the company.

This is not to say it’s easy. For one thing, Brent has had to break old habits. That’s difficult. But my goal is to push him out of his comfort zone in a way that causes willingness to raise new behaviors while preventing him from making ultra-risky, bet-the-company decisions like introducing price changes to gain market share, hiring non-producing sales people, or getting rid of a sales force.

As I work with companies like his that have enjoyed years of success, I’ve enabled them to make course corrections a step at a time. The end result has been that they’ve sharpened their views on the kinds of businesses they want, the kinds of services they deliver, and they’ve stopped trying to be all things to all people. These are hard choices that emerge from recognizing that everything they may be involved in is not a business.

Andy Birol is the Founder and President of Birol Growth Consulting, www.andybirol.com. You can reach him at 412-973-2080 or at abirol@andybirol.com.